|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Loan Interest Rates Today: Insights and Practical AdviceIntroduction to Current Loan Interest RatesIn today's financial landscape, loan interest rates are a crucial factor for anyone considering borrowing. Whether you're looking at a mortgage, a personal loan, or a low interest home equity loan, understanding the current rates can help you make informed decisions. Factors Influencing Loan Interest RatesEconomic IndicatorsInterest rates are heavily influenced by economic indicators such as inflation, employment rates, and the Federal Reserve's monetary policy. These factors contribute to the overall cost of borrowing and can fluctuate based on economic conditions. Credit Score ImpactYour credit score plays a significant role in determining the interest rate offered by lenders. Generally, a higher credit score can help you secure a lower interest rate, making it crucial to maintain good credit health.

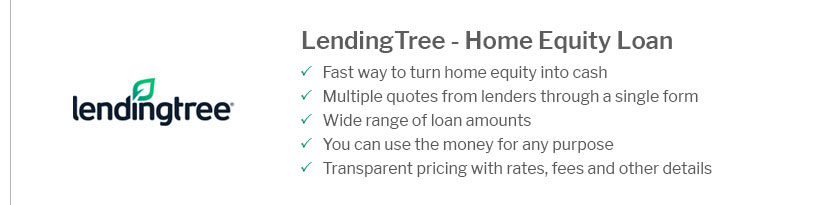

Types of Loans and Their Interest RatesMortgage LoansMortgage interest rates vary based on factors such as loan type, term, and lender. For those seeking competitive rates, exploring options from the best banks for mortgages ny can provide valuable insights. Personal LoansPersonal loan interest rates are generally higher than mortgage rates but are influenced by the borrower's creditworthiness and the loan amount. Fixed-rate personal loans can offer stability in repayment planning. Home Equity LoansHome equity loans typically offer lower interest rates than personal loans, as they are secured by your home's equity. It's essential to compare different lenders to find the best rate available. Tips for Securing the Best Loan Interest RatesTo obtain favorable loan interest rates, consider the following strategies:

FAQWhat is the average mortgage interest rate today?The average mortgage interest rate today varies by region and loan type, but generally, it hovers around 3% to 4% for a 30-year fixed mortgage. How can I lower my loan interest rate?Improving your credit score, choosing a shorter loan term, and comparing offers from different lenders can help you secure a lower interest rate. Are interest rates expected to rise soon?Interest rates can fluctuate based on economic conditions. It's advisable to stay informed about Federal Reserve announcements for any anticipated changes. ConclusionUnderstanding the dynamics of loan interest rates today can empower you to make better financial decisions. By considering the factors that influence these rates and actively seeking the best options available, you can effectively manage your borrowing costs and achieve your financial goals. https://www.rocketmortgage.com/mortgage-rates

Today's Rocket Mortgage Rates ; 30-Year Fixed - 7.125% - 7.449% - 2 ($5,500.00) ; 20-Year Fixed - 6.99% - 7.408% - 2 ($5,500.00) ; 30-Year FHA - 6.375% - 7.261% - 1.875 ($ ... https://www.fsa.usda.gov/tools/informational/rates/current-fsa-loan-interest-rates

For loans with rates variable or fixed for less than 5 years: The prior business day's SOFR plus 6.75%. For loans with rates fixed for 5 years ... https://studentaid.gov/understand-aid/types/loans/interest-rates

Interest Rates for Direct Loans First Disbursed on or After July 1, 2024, and Before July 1, 2025 ; Direct Unsubsidized Loans. Graduate or Professional. 8.08%.

|

|---|